Why Ateme

Captivate your audience with a superior quality of experience

Boost audience engagement

Acquire

new viewers

Unleash new monetization potential

Go green

Ateme offers fully integrated solutions for video delivery that help you boost viewership engagement, acquire new customers, and unleash monetization potential.

Captivate your Audience

High-performing processing

Smart CDN solutions

Key Figures

Powering World Leaders

Latest News

Ateme Wins a 2024 Google Cloud Partner of the Year Award

In Industry Solution – Technology: Media & Entertainment category Paris, France, April 9, …

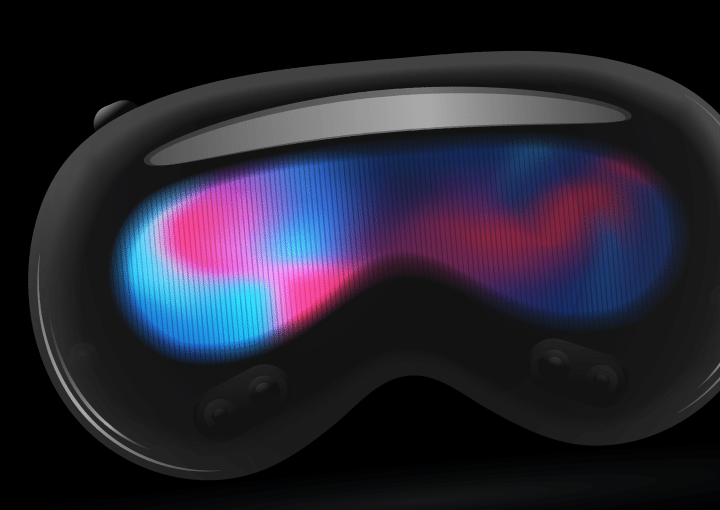

Ateme to Speak about Enabling Immersive Media Experiences on the Apple Vision Pro at NAB Show 2024

Ateme’s Experts and industry leaders from Apple, Disney and Dolby Laboratories will discuss how to unlock …

Events

ANGA COM 2024

Are you ready to take video experiences to the next level – while also reducing costs with flexible and …

2024 NAB Show

Step into the future of video delivery with Ateme at the 2024 NAB Show! Join us at booth W1721 to experience …

Where to meet us in April 2024

Meet our experts face-to-face at a trade show or hear them discuss the latest disruptive technologies in our live …